Banks, credit unions, and financial institutions have long used access control as part of their physical security system. However, as crimes have become more sophisticated, the technologies used to defend against them must follow suit.

How can your financial institution improve its physical security to combat the advanced strategies of bad actors?

Many financial institutions are now using biometrics as part of their access control and physical security systems. Simply, biometrics automatically identifies people using physical characteristics like fingerprints, iris, or facial scan.

Financial Institutions that use biometrics enjoy a higher level of security. Biometrics can safeguard your back office, processing centers, branch locations, data centers, and other areas that contain confidential data or vital assets.

Here’s a rundown of everything you need to know about updating your bank security using biometrics.

Why is facial biometrics so effective in bank security?

Legacy access control systems that use access cards, keypads, or keyfobs are generally adopted but can easily be tampered with or cloned, making the overall system ineffective. In addition, replacing lost cards can be costly and time-consuming.

Other biometric credentials such as fingerprint, iris, or palm readers create a higher level of security, but they can be cumbersome, create sanitary concerns, increase system friction, and can malfunction in adverse weather conditions.

But with facial biometrics, each person’s face is inherently unique and can never be cloned or stolen. This technology makes it nearly impossible for unauthorized individuals to manipulate your bank’s security to access your critical data and assets.

What are the steps typically involved in using facial biometrics for financial institutions?

At a high level, using facial biometrics for your financial institution involves the following steps.

- Enrollment: Users enroll at an established enrollment station or through self-enrollment on their mobile device

- Authentication: When a user attempts to access a secure area, the biometric system performs an authentication check by comparing the biometric data at the time of access to the enrollment data.

- Authorization: If the biometric data matches, the user is granted access. If the data does not match, the user is denied access.

- Monitoring & Reporting: The facial biometric system monitors and reports user activity. It alerts your system administrator of suspicious behavior, such as tailgating or unauthorized access.

Where can you use facial biometrics in your financial institution?

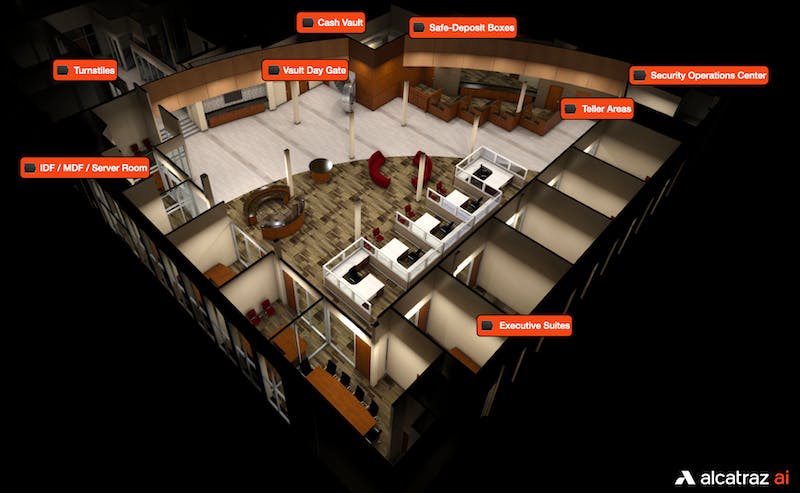

Financial services companies are relying on facial biometrics in their facilities for protection. This advanced technology allows them to safeguard employees and assets in data servers, cash storage, vaults, executive offices, and more. Facial biometrics can eliminate the need for costly security guards at every entrance, providing you with a secure environment at all times.

See where other banks are implementing facial biometrics in their organization.

What should you look for in a facial biometric access control system?

When considering a biometric access control system for your financial institution, consider the following:

- Accuracy: Ensure the facial biometric system has a high level of accuracy to minimize the risk of false acceptances or errors.

- Integration with existing systems: The access control system should easily work with your existing video management system, cameras, and alarms to provide a comprehensive security solution.

- Scalability & Flexibility: As your business grows, the biometric system should accommodate an increased number of users and locations.

- User Management: Does the system provide a user-friendly interface for managing and enrolling users? This should include the ability to add, delete, and modify user accounts or assign or revoke access rights.

- Data Privacy and Security: The biometric system should have robust security features to protect sensitive user data. It should adhere to the latest privacy laws like BIPA, CCPA, and GDPR.

- Tailgating Detection: Pick a system that autodetects tailgating incidents and immediately alerts system administrators without needing special equipment or dedicated staff.

- Technical Support: The biometric system should come with reliable technical support to ensure that the system is functioning properly and to provide assistance in the event of any technical issues.

Why choose Alcatraz AI for your access control security needs?

Alcatraz AI revolutionizes how financial institutions use access control systems by offering frictionless facial biometric solutions powered by artificial intelligence (AI) and machine learning.

The Alcatraz AI Rock, our award-winning edge solution, delivers frictionless access and strengthens security in an all-in-one biometric device. It safeguards high-value areas like data servers, cash storage, vaults, and safety deposit boxes and protects people on-premises, eliminating the need for high-cost security guards at each entrance.

Here are just a few of the reasons why the Alcatraz AI Rock is the best solution for your physical security.

- Frictionless User Experience: Create fewer touchpoints when entering a controlled space by using 3D facial authentication.

- Multi-Factor Authentication: Combine two or more authentication factors to add a layer of protection to a restricted area in a zero-trust environment.

- Easy-to-implement & Scale: Seamlessly deploy the Rock to any access control system for easy adoption, not requiring a retrofit or any integration.

- Tailgating Detection: The Rock is designed to alert if an unauthorized person enters and sends real-time notifications to your access control system or video management system.

- Privacy & Security: Our technology is focused on privacy, compliance, and data security with end-to-end encryption and cloud or on-prem options. It is designed in compliance with the latest privacy frameworks, including General Data Protection Regulation (GDPR), the Illinois Biometric Information Protection Act (BIPA), and the California Consumer Privacy Act (CCPA).

- Simplified User Management: Our uncomplicated enrollment process, which includes mobile enrollment and privacy consent management, allows employees to opt-in or out without increasing the burden on your system administrators.

These features come together with other Alcatraz functions to facilitate a safe and secure environment, bringing your bank operations to modern standards.

Book a demo today to see how Alcatraz AI can better protect your financial institution.

Tag(s):

Blog

Other posts you might be interested in

View All Posts

Press Release

3 min read

| August 8, 2023

Alcatraz AI Raises the Bar with New Biometric Privacy and Enrollment Functions for Secure and Effortless Access Control at GSX

Read More

Press Release

5 min read

| February 21, 2023

Fast Security Onboarding with Mobile Enrollment & Privacy Consent

Read More

Blog

6 min read

| July 7, 2022

Facial Authentication: A Solution to Proximity Card Shortages

Read MoreSubscribe to email updates

Additional content around the benefits of subscribing to this blog feed.